Changelog

Follow up on the latest improvements and updates.

RSS

The arrival of the 1099-DA marks the biggest shift in crypto taxes to date. For the first time, millions of Americans will receive digital asset tax forms, and the IRS will know what you owe. It’s a turning point for the entire industry.

We’ve spent the past year refining every layer of CoinTracker — our infrastructure, accuracy engine, and end-to-end experience — to ensure you’re ready the moment those forms arrive.

The result: a faster, smarter, and more intuitive CoinTracker that helps you make sense of it all.

As the underlying infrastructure powering 1099-DA compliance for top exchanges, tax professionals, and DIY software, we connect the entire ecosystem, minimizing your compliance risk and streamlining crypto tax filing from start to finish.

Whether you’re filing crypto taxes for the first time, or reconciling 1099-DAs against years of cost basis across wallets and chains, CoinTracker delivers institutional-grade accuracy with consumer-grade simplicity, giving you clarity, confidence, and control in a year when it matters most.

1099-DA, explained

From January 1st to February 15th 2026, crypto brokers will begin issuing 1099-DA forms to users. It’s the most significant change to crypto tax reporting in a decade, and it’s poised to create confusion for millions.

CoinTracker is the only crypto tax platform designed to support the full 1099-DA lifecycle — from ingestion to reconciliation to final filing. We help generate complete and accurate tax forms in minutes by leveraging your full transaction history to fill in gaps on 1099-DA forms from every exchange.

As forms roll out, accuracy becomes non-negotiable — and CoinTracker is built to keep you on the right side of the IRS.

Here’s how it works:

- Ingest & match:Pull 1099-DA data alongside connected wallets and exchanges.

- Reconcile cost basis:Our upgraded transaction modeling and cost basis engine map broker-reported activity to your underlying trades and transfers.

- Flag discrepancies:Account Health highlights missing, mismatched, or suspicious data before you file.

- Export cleanly:Generate IRS-ready reports and e-file via TurboTax or H&R Block.

In short:

CoinTracker takes fragmented 1099-DA data and turns it into a complete, IRS-ready tax picture, before small gaps become expensive mistakes.

What’s new at a glance

Here’s what’s new in CoinTracker this season:

- Built around 1099-DAs:Native support for 1099-DA intake and reconciliation, from ingest to export; an entirely new end-to-end tax filing journey, improved transaction and asset views, smarter EVM wallet detection, and clearer tax-year checklists on web and mobile.

- Embedded CoinTracker:We now power native crypto taxes experiences within exchanges across the industry! Starting this season, you will begin seeing CoinTracker embedded deeper into your favorite brokers, including Coinbase. And behind the scenes, our infrastructure also supports broker-side cost basis and 1099-DA form generation at scale.

- Foundational upgrades:New cost basis infrastructure that can handle millions of transactions per user, plus smarter rules around income, staking, and complex DeFi. Plus support for new chains and exchanges, including Unichain, Monad, and Hyperliquid’s HyperEVM.

Together, these upgrades make CoinTracker the most scalable and reliable crypto tax system ever built, just in time for 1099-DAs.

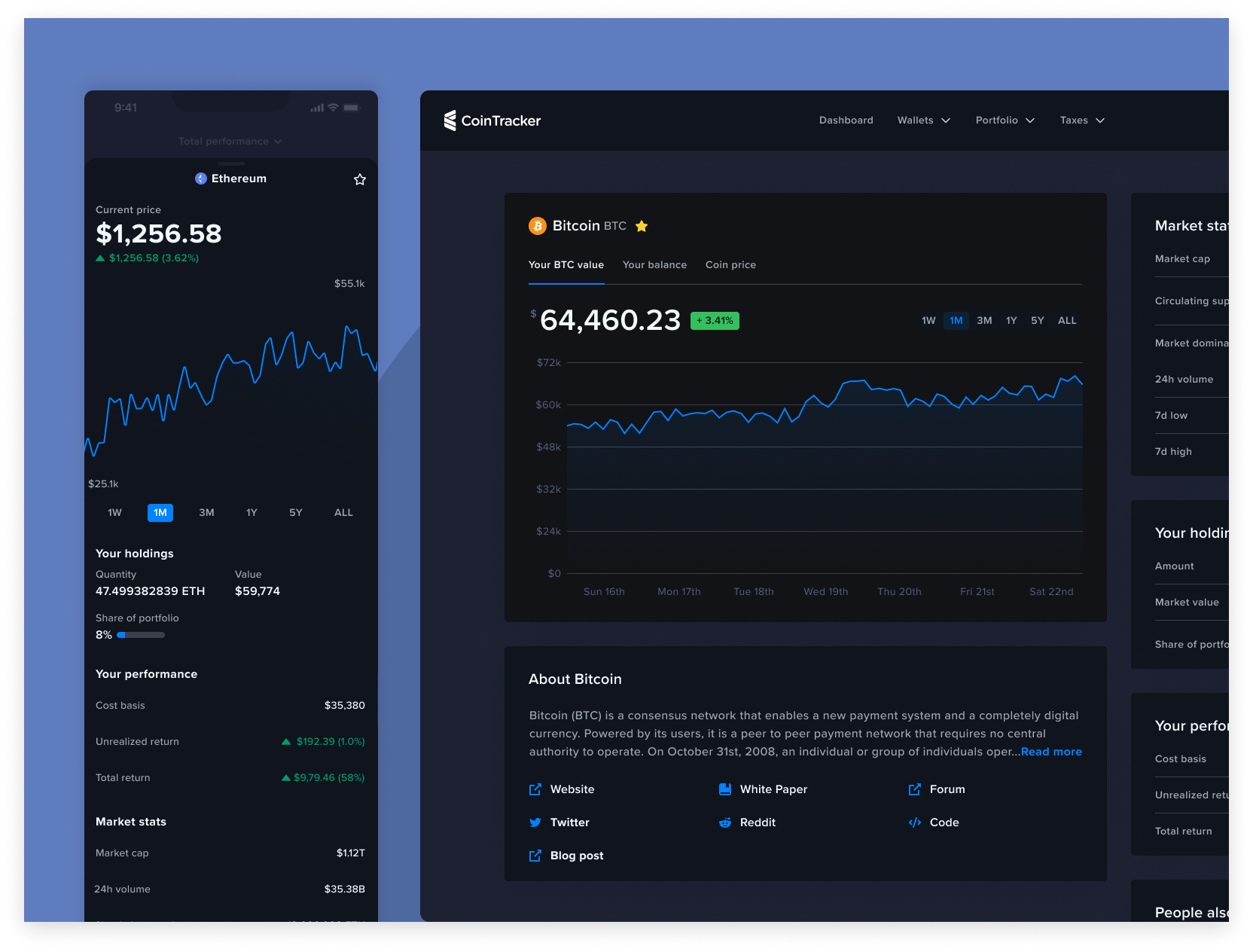

A faster, simpler, calmer UX, built around 1099-DAs

We’ve redesigned CoinTracker to feel effortless from onboarding (including 1099-DA ingestion) to final filing.

Key updates:

- Entirely new tax filing journey: Follow a guided flow that tackles high-impact issues first, surfaces transactions you might be overpaying on, and walks through 1099-DA reconciliation step-by-step — all designed to help you file faster with confidence.

- Smarter EVM onboarding:When you add an EVM wallet, CoinTracker now auto-detects which supported chains actually have activity and recommends only those, cutting clutter and setup time.

- Account Health everywhere:CoinTracker now proactively monitors your connected accounts and flags anything that could impact accuracy like sync issues or balance mismatches. You’ll see alerts right on the mobile home screen, so you can fix issues as they come up and head into tax time with fewer surprises.

- Better transactions & assets views:Faster CSV imports, improved Solana and UTXO handling, quality-of-life updates to the Transactions page, search and filters on Assets, and richer token/NFT imagery for a more legible portfolio.

Every update is designed to reduce complexity so you can file with confidence.

The infrastructure behind crypto’s tax future

This tax season, CoinTracker is powering the crypto tax experience not just for individuals — but across the industry.

From CoinTracker’s embedded tax center serving millions of Coinbase users to our Cost Basis Engine powering institutional tax compliance across 15 exchanges, our infrastructure now supports 1099-DA compliance at every level.

This is the foundation behind CoinTracker Enterprise’s Broker Tax Compliance Suite — a complete 1099-DA compliance suite trusted by top exchanges, brokers, and tax software platforms. It brings together everything needed to generate accurate forms, reconcile missing cost basis, and deliver a seamless experience to users.

Broker Tax Compliance Suite highlights:

- Embedded tax center:A native, in-platform experience that helps users complete their cost basis and access tax documents with ease.

- Broker-grade cost basis engine:Supports full historical import, tax lot tracking, and high-scale reconciliation with proven performance across millions of transactions.

- 1099-DA generation and filing:Automates compliance across federal and state levels, helping exchanges meet IRS 6045 requirements on time and at scale.

For brokers, CoinTracker is the compliance engine. For users, it’s peace of mind embedded directly into the platforms they already use.

The accuracy engine behind it all

Getting crypto taxes right means getting the details right, and CoinTracker is the only platform built with the depth, coverage, and engineering rigor to do that at scale.

Our infrastructure handles the complexity of DeFi, NFTs, and cross-chain activity at scale, ensuring unmatched accuracy for every user.

What’s new under the hood:

- New cost basis infrastructure:Our rebuilt cost basis infrastructure removes prior scalability limits and supports portfolios with millions of transactions, powering both user and broker-grade accuracy.

- DeFi coverage expansion:Added support for concentrated liquidity pools on SushiSwap and PancakeSwap, Hyperliquid funding payments, and broader DeFi position tracking including SUI staking.

- Solana & L1 upgrades:Migrated Solana to a new high-throughput backend. Rebuilt our Bitcoin, Litecoin, Cardano, and Stellar integrations for significantly better performance and correctness, especially for high-volume wallets.

- More chains, fewer gaps:Added native support for a wave of new L1s and L2s like Unichain, Monad, Berachain, Soneium, Astar, Abstract, and HyperEVM, so your tax view follows you wherever you trade.

- Global tax logic:Expanded international support with improved tax rules for Germany, Italy, Spain, and more. Includes new configuration options like classifying unmatched receives as income, where required by local law.

Whether you're a crypto investor, a tax pro, or a global exchange, CoinTracker’s foundation gives you the confidence that every detail is accounted for, and every calculated number is correct.

The 1099-DA has arrived, and we’ll have you ready

This year marks a new standard for crypto tax compliance. And CoinTracker is here to hold your hand through the murky waters.

With unparalleled accuracy, speed, and clarity, CoinTracker gives you the confidence to stay ahead of regulation, stay in control of your finances, and navigate whatever comes next.

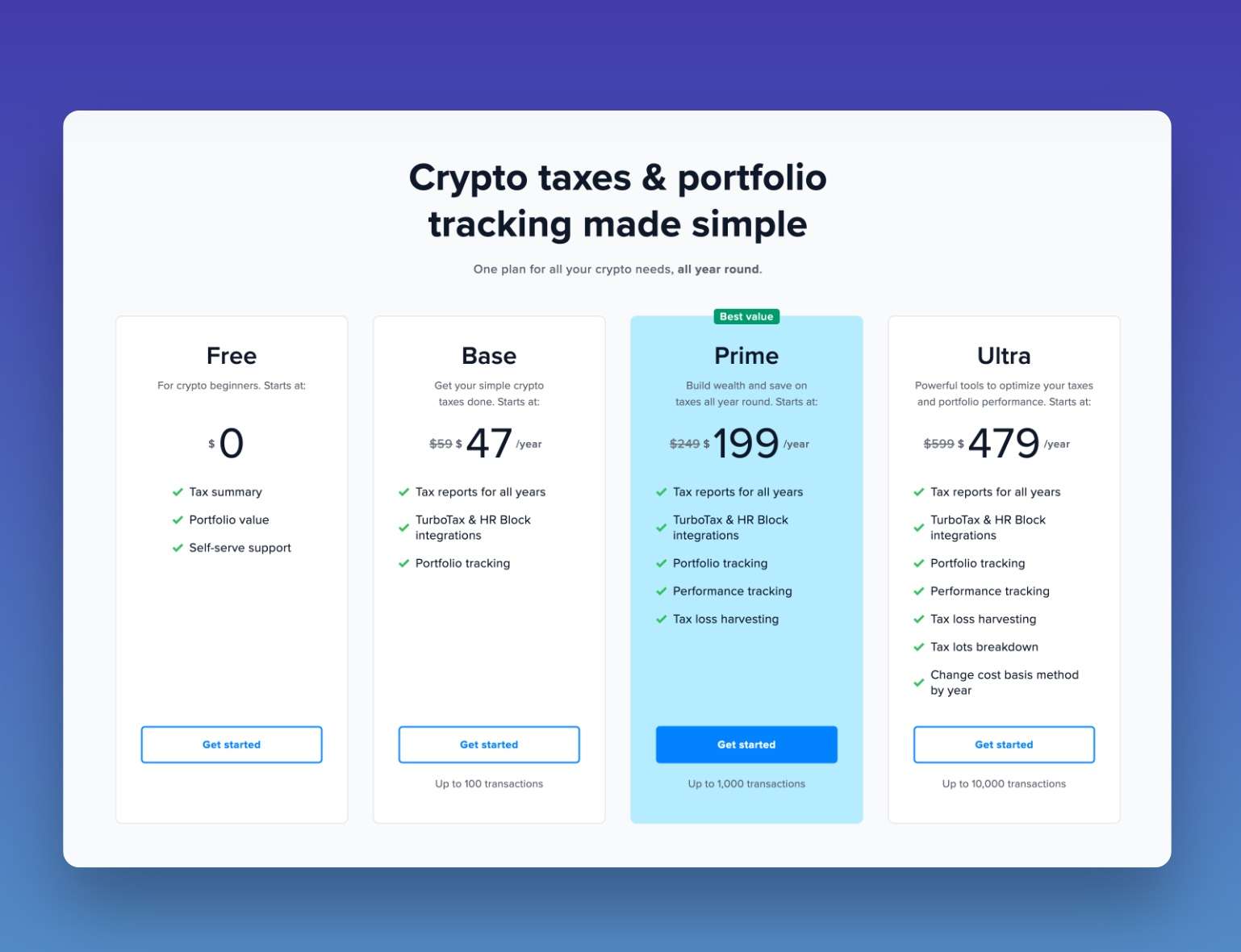

Early bird sale is live

Kick off tax season early: new users save 20% with our annual Early Bird sale.

Every plan includes portfolio tracking, tax reports, and 1099-DA reconciliation — all in one place.

With tax season in full swing, we’ve been working hard to make crypto taxes simpler and more accurate than ever before. Since our last update, we’ve launched

new blockchain integrations, enhanced tax reporting, improved syncing, and a major rebrand.

Here’s everything you need to know:🔥

What’s new?

🛠️ Expanded blockchain & DeFi support

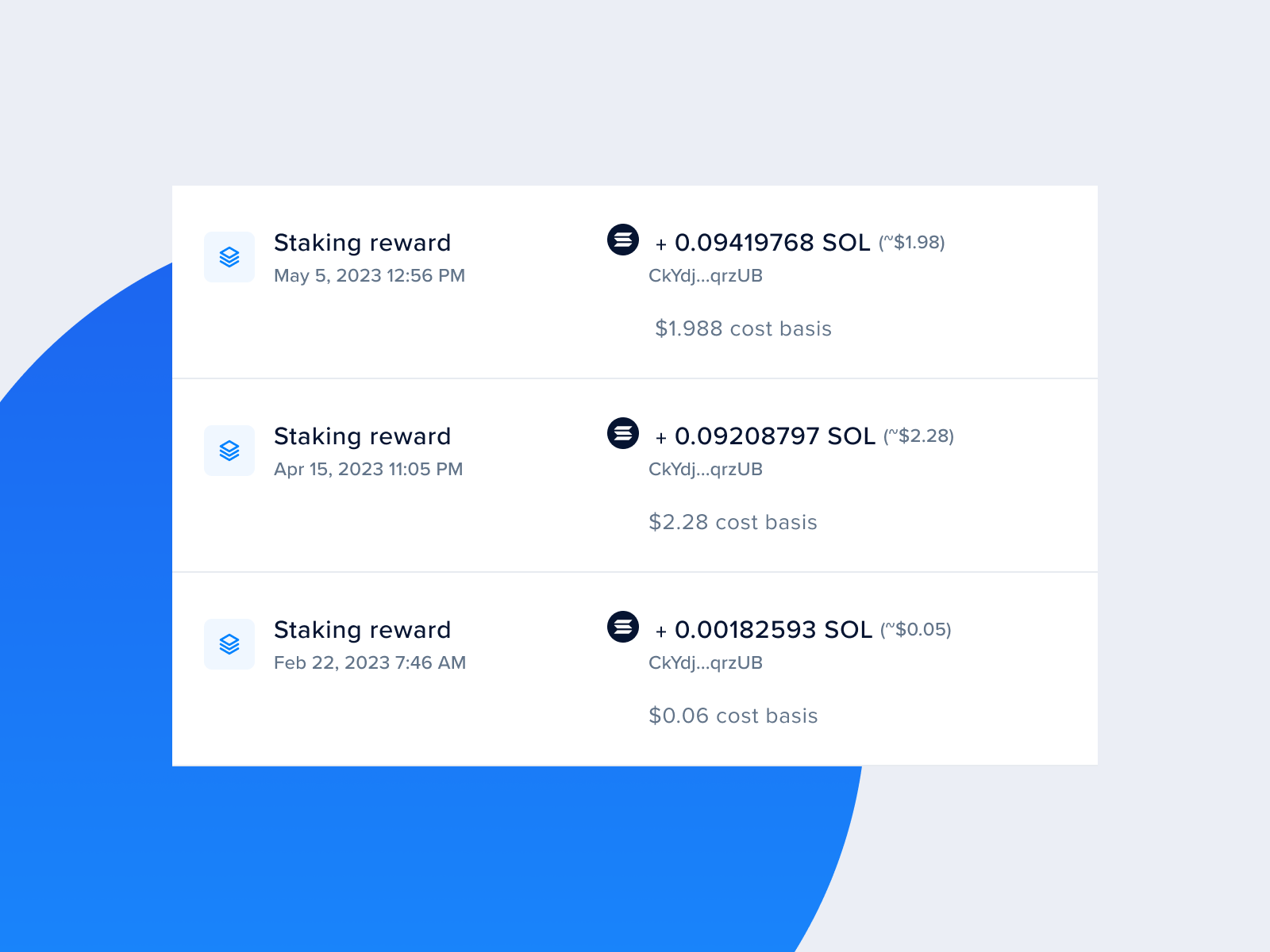

- Solana native stakingis now supported — Your staking and MEV rewards are correctly tracked and auto-categorized

- DEX pool pricing powered by DeFiLlama— We’ve integrated pricing for50,000 onchain assets across 27 networksto improve cost basis calculations

- Multi-asset bridged transfer detection— Accurately track bridged assets across chains

- Hedera support— Automatically sync yourHBAR transactions, NFTs, fungible tokens, and staking rewards

- NEAR support— CoinTracker now supports all your DeFi activity on NEAR, including fungible tokens, NFTs, and staking rewards by epoch

- Kusama support— CoinTracker now supports Kusama, including auto-categorization for staking and crowdloan transactions

- Aptos support— CoinTracker now supports Aptos, including fungible tokens, NFTs, and auto-categorization for DeFi transactions

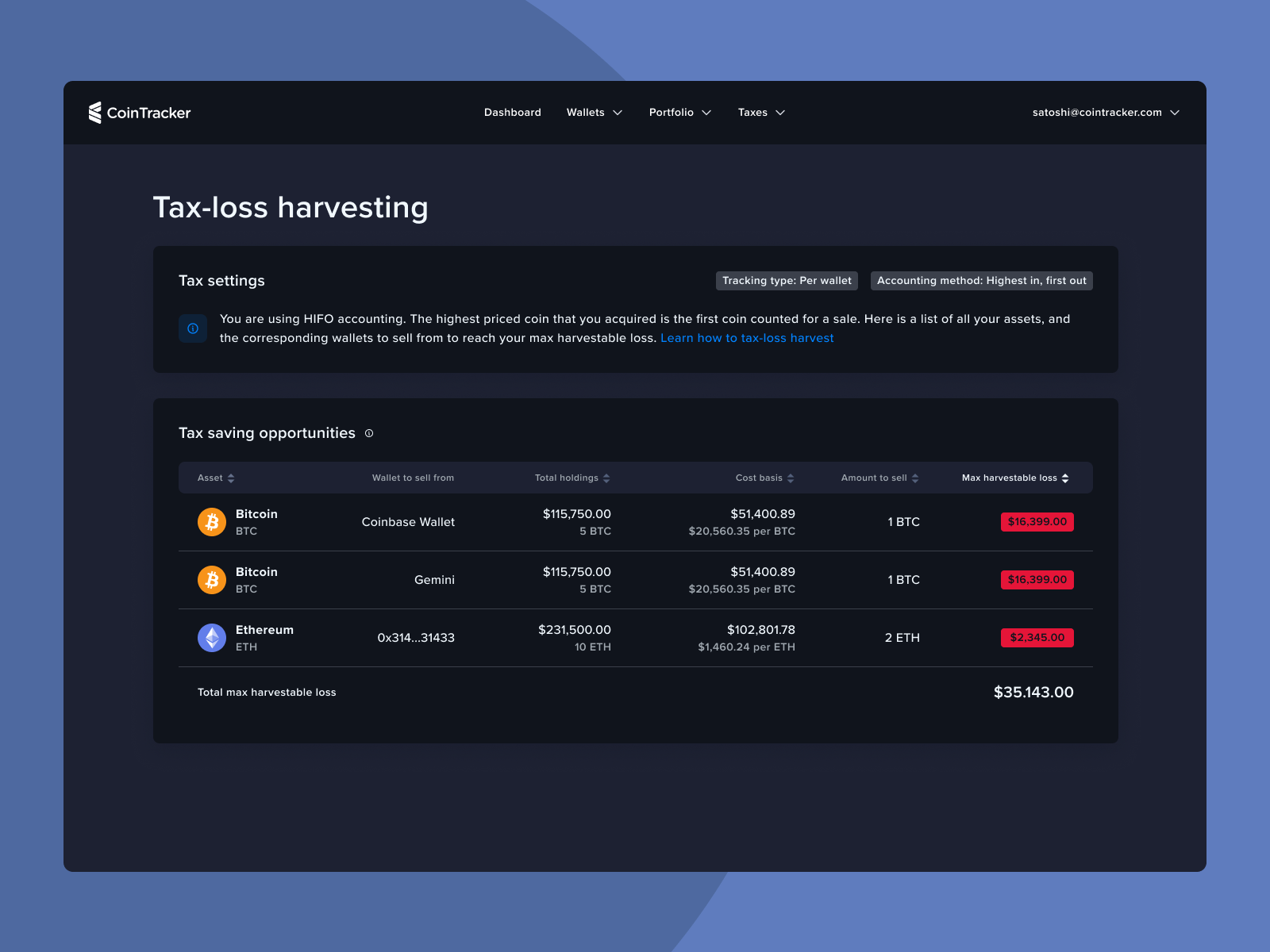

💸 Compliance & taxes

- 1099-DA compliance:OurUniversal to Per-Wallet Migrationenables US users to comply with the latest IRS reporting rules

- Tax loss harvesting upgrade:Newintegrated tax lots viewmakes planning disposals and optimizing tax savings easier

⚡ Faster and more reliable syncing at scale

- Improved sync performance and faster calculations for accounts with millions of transactions

🔐 Enterprise-grade features

- Enterprise journal entry rulesfor automated transaction classification at scale

- Multi-factor authentication (MFA)for Enterprise logins

🚀 A completely refreshed brand

- Rebrand complete— A fresh look, better navigation, improved usability, and re-imagined CoinTracker that optimizes for ease of use

⚖️ 100s of optimizations

- Besides launching our latest features, we’ve also been improving existing ones, resolving issues, and making tweaks based on your feedback

For more, follow us on X. If you’re enjoying CoinTracker, please leave us a review on Trustpilot, the App store, or the Play store. We’re excited to help you tackle tax season with

the most powerful and trusted crypto tax platform

out there. Thanks for being a part of CoinTracker!Until next time,

The CoinTracker Team

new

improved

fixed

March update

Spring has arrived, which means it’s officially time to complete your crypto taxes with ease using CoinTracker. We are excited to share our latest product updates with you:

🌌

Industry-leading Solana support

CoinTracker now automatically and accurately imports and categorizes every Solana transaction, from your initial onramp to the latest DeFi or NFT activity. With comprehensive coverage, we handle everything from token swaps to native SOL and token staking, NFT transactions, liquidity pools, yield farming, lending, rent fees, and more.

⛓️ zkSync Era chain integration

We just launched a new integration for the zkSync Era, which includes top-tier support for DeFi transaction on the network, so that you can calculate your taxes across the Ethereum L2 ecosystem with ease. Add your zkSync Era wallet today.

👾

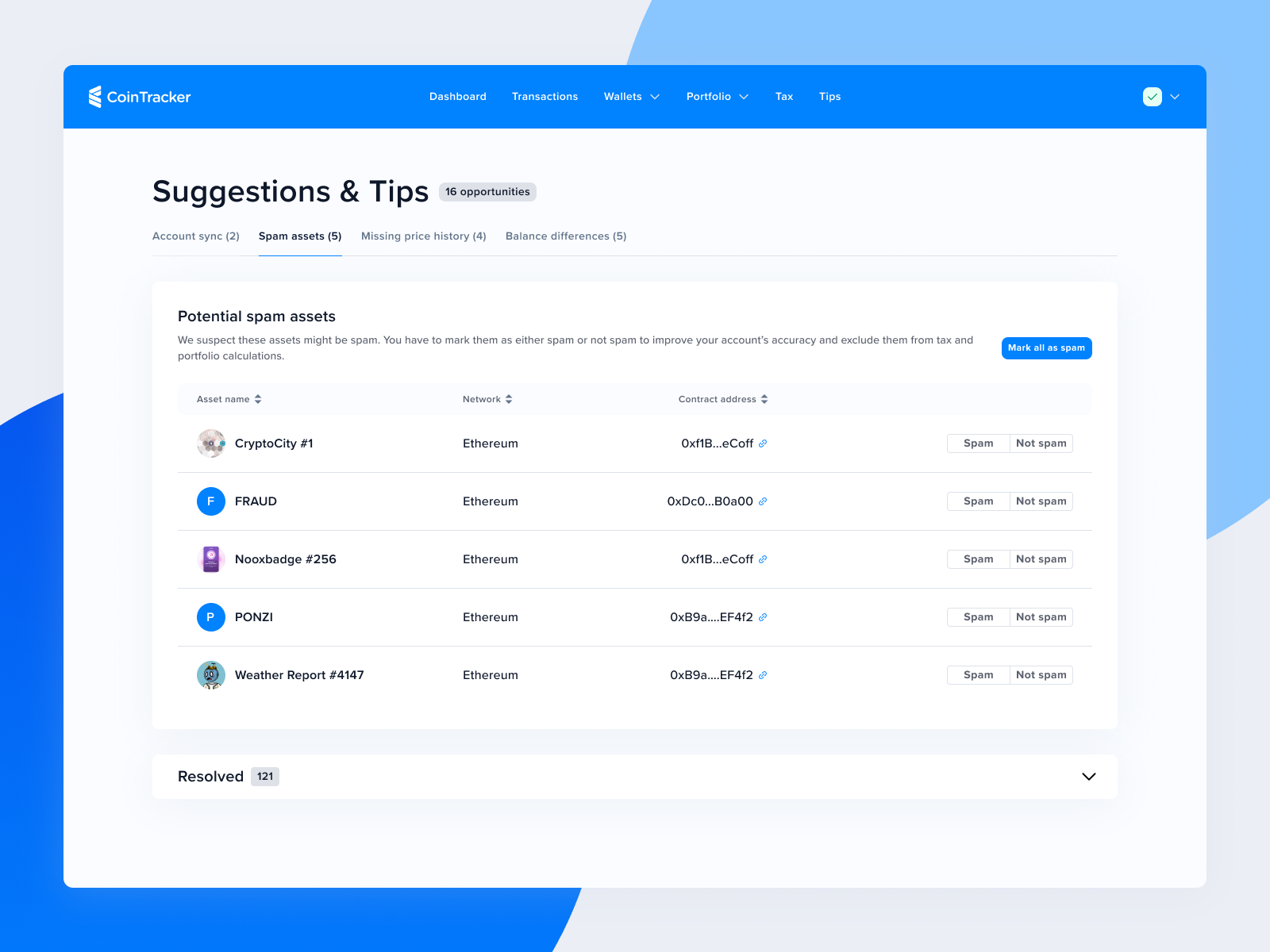

Automatic spam detection

CoinTracker now auto-detects and hides spam, automatically excluding it when determining which plan tier is best for you. We catch over 1.5 million spam tokens across Ethereum, Solana, Polygon, and more. We also update this list every few minutes to protect you from the latest spam.

📈

Sort transactions by gains or losses

You can now easily sort transactions by largest gains or losses to review your most important crypto activity quickly. Check it out on our revamped transactions experience today.

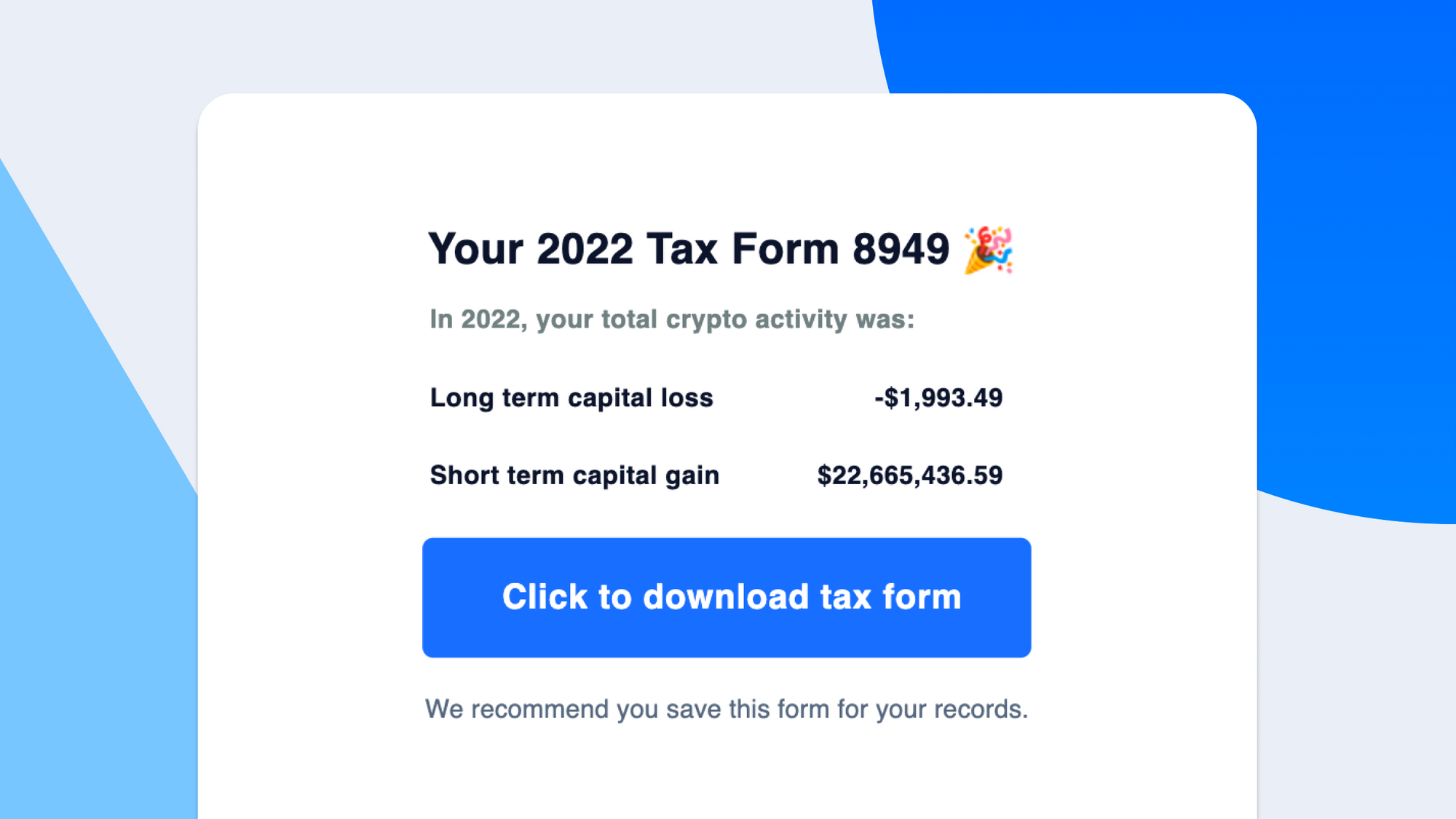

📁

Tax form downloads

We heard your feedback loud and clear — CoinTracker now ensures that tax forms are automatically downloaded after you hit generate. Forms are also emailed so they’re easily accessible for future reference.

🐞

Latest bug fixes and small improvements

- Launched Crypto.com, Celsius, and BlockFi CSV integrations for seamless taxes

- Enabled a re-import option to help improve transaction accuracy on wallets

- Introduced a transaction value column to quickly view largest transactions

- Added feature previews on plans to easily see what you’ll get in each tier

- Addressed a bug related to transfers between Futures and Spot Kraken wallets

- Improved MagicEden NFT transaction accuracy for listing and selling NFTs

- Fixed issues on the tax professional dashboard showing erroneous purchases

For more, follow us on Twitter. If you are enjoying CoinTracker, please leave us a review on Trustpilot, the App store, or the Play store.

new

improved

fixed

February update

Valentine’s day is around the corner and we are thrilled 😍 to share our latest product updates with you:

🔮 Advanced DeFi support

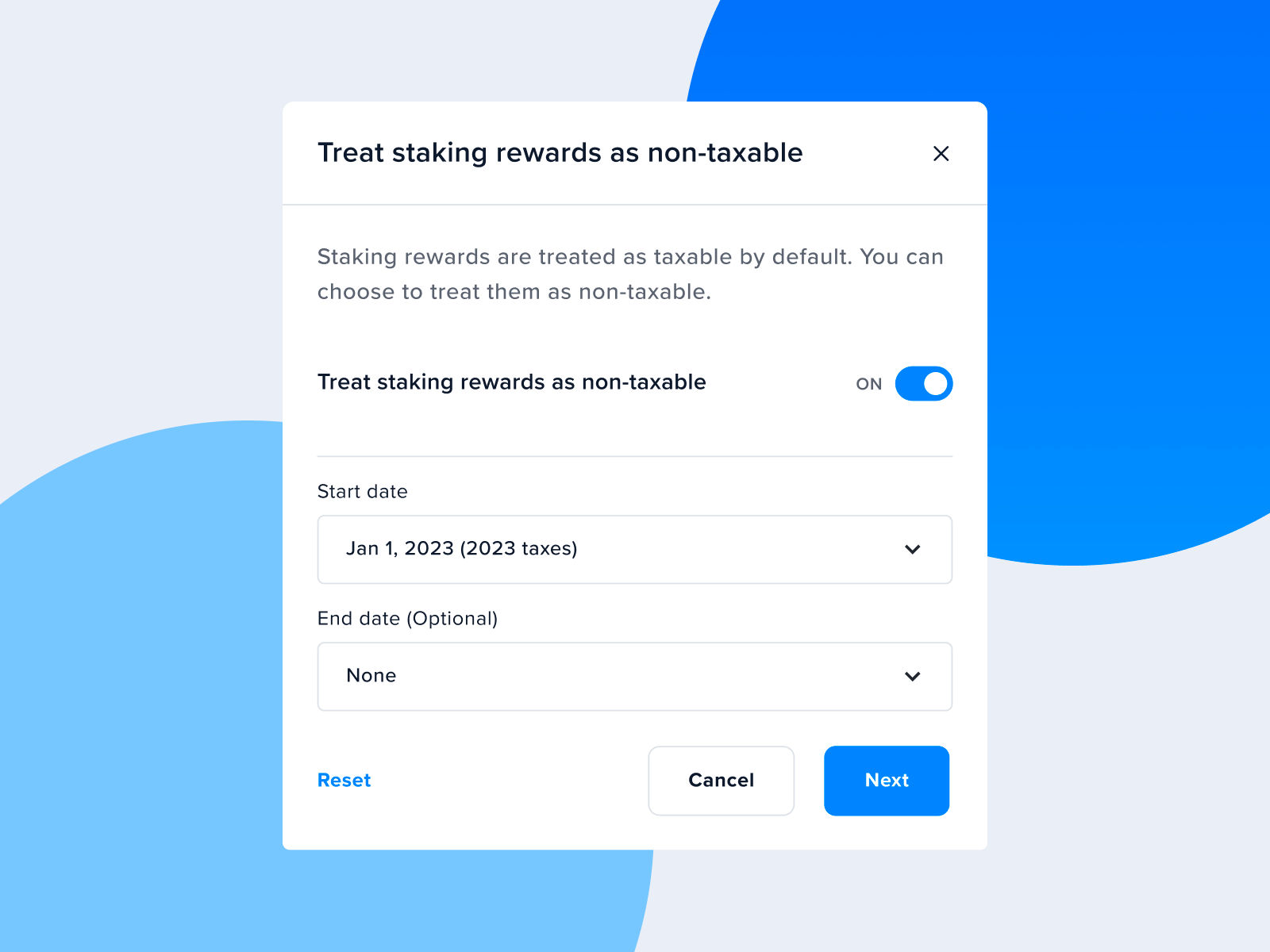

CoinTracker now supports Uniswap, Lido, Aave and 23,000+ smart contracts. That means no manual editing, no errors—just add your wallet and let CoinTracker take care of the rest. You can also set rules to treat wrapping, staking, liquidity pool, and lending transactions as non-taxable.

💸 Year round value with a single subscription

Users consistently asked us for a single price covering all CoinTracker offerings, including tax calculation, portfolio tracking, and tax reports for all years. We heard you ❤️. We’ve combined our tax and portfolio tracking products into a single subscription that provides more year-round value.

⚡Add Wallet via WalletConnect

You can now add EVM wallets easily in CoinTracker with WalletConnect. WalletConnect supports over 300 wallets like Coinbase, MetaMask, Rainbow, etc. Add your wallet today.

🔍 Search for your wallets

We added a search bar so you can easily find wallets by name or specific chains

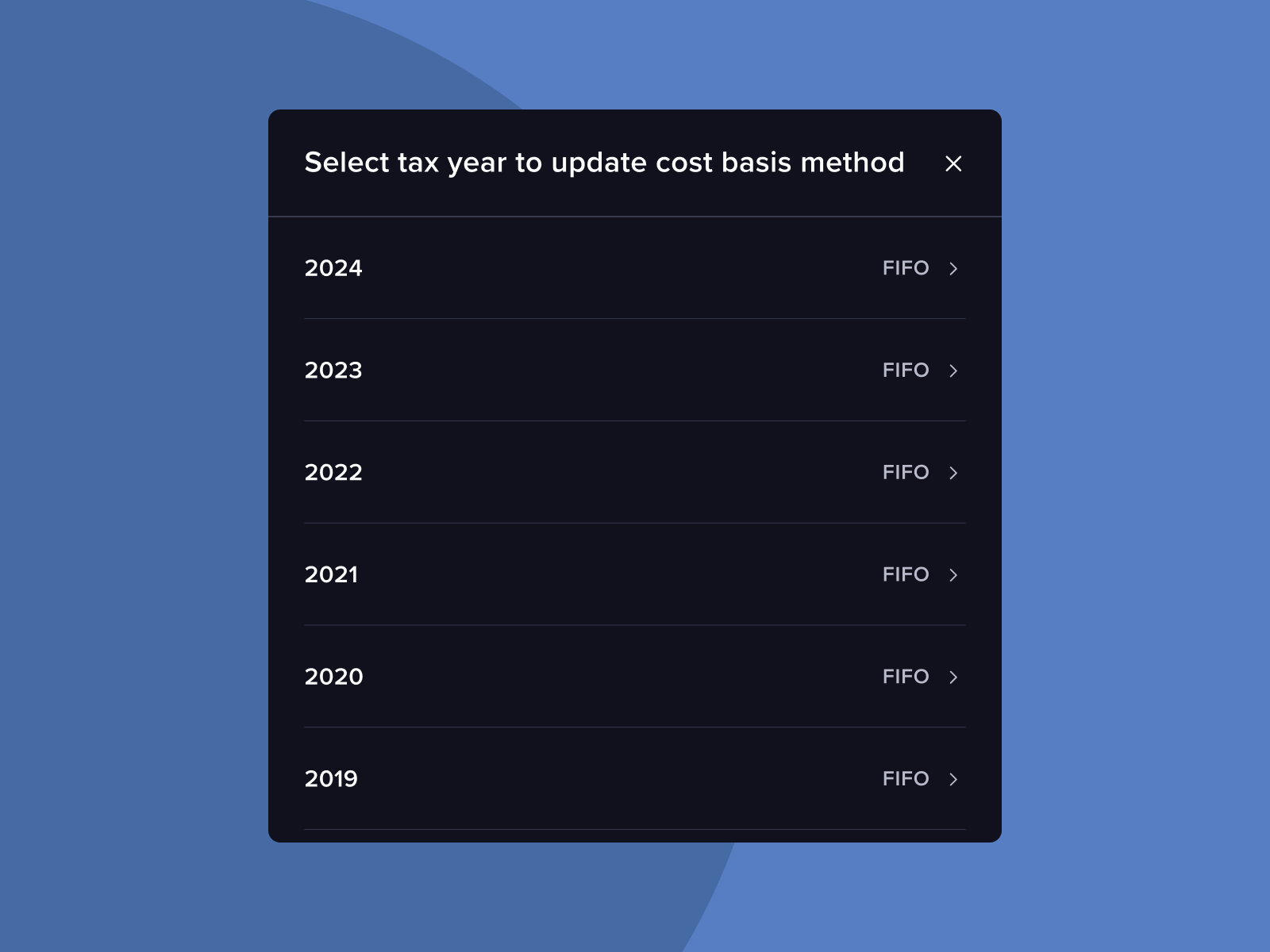

📅 Change your cost basis method without affecting past tax years

If you have an Ultra plan, you can pick your cost basis method by year. Changes will not affect past tax years, allowing you to optimize your taxes.

🐞

Latest bug fixes and small improvements

- Transactions page displays wallet network associated with on-chain transactions

- Unmark tokens as Spam directly from the transactions page

- ETH staked on Coinbase is displayed as ETH instead of ETH2

- Fixed bug causing some LP tokens to get an incorrect cost basis

- Resolved inaccuracies with fees for Coinbase advanced trade orders

- Tidied up how bridge transactions on Arbitrum are displayed

For more, follow us on Twitter. If you are enjoying CoinTracker, please leave us a review on Trustpilot, the App store, or the Play store.

new

improved

fixed

January update

Hope your 2024 is off to the races! We are excited to share our latest product updates with you:

🔌

Native Solana staking support

Tracking staking rewards is easier with CoinTracker. Solana staking rewards received on withdrawing your stake are auto-tagged and included as taxable income in reports.

🏦 Set rules for taxability of DeFi transactions

You can set rules to treat wrapping, liquid staking, liquidity pool, and lending transactions as non-taxable (except if you’re in the UK). Regulations on how to tax them are ambiguous and vary by country, so consult your tax professional before changing default tax treatments.

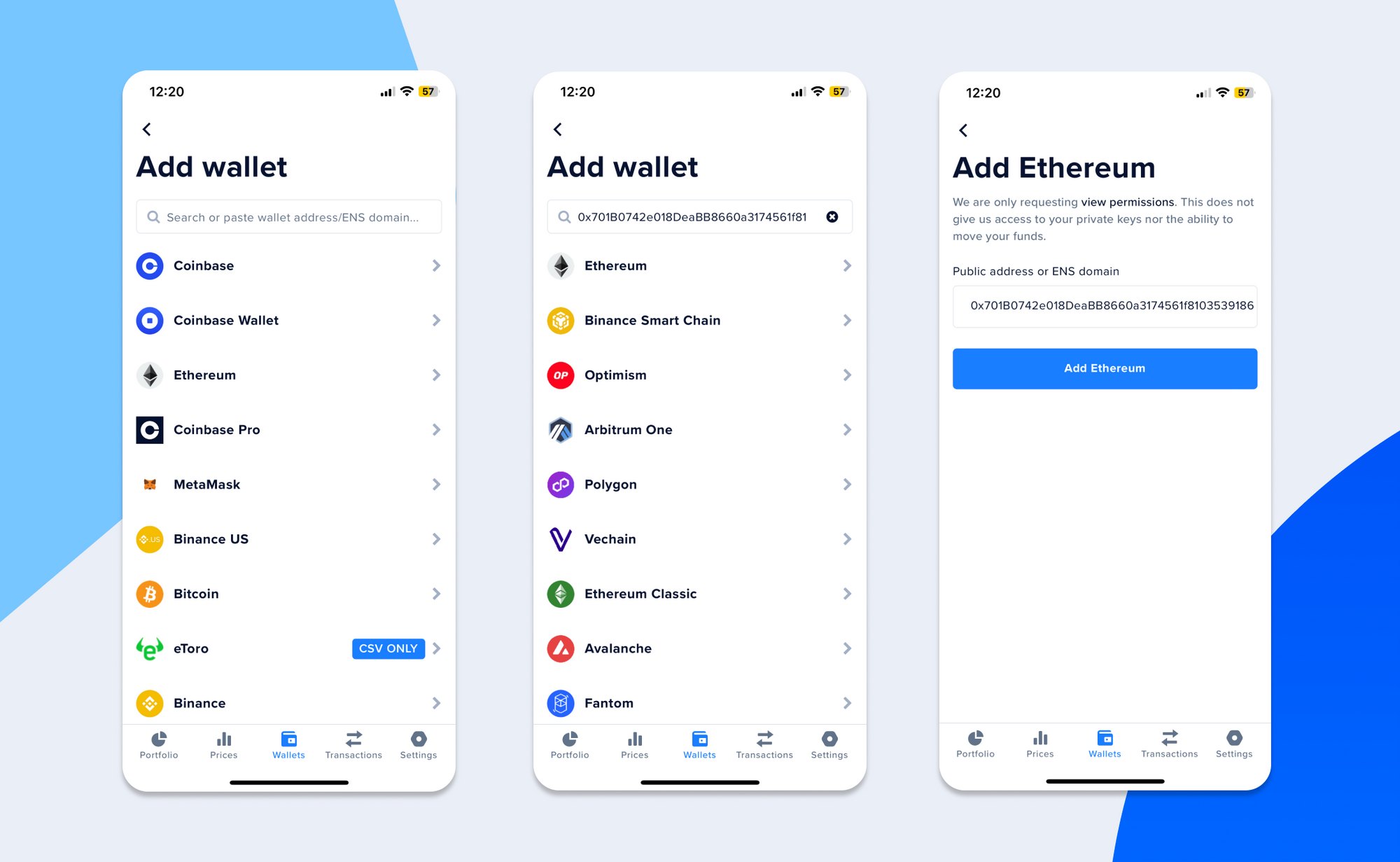

🤯 Add all EVM wallets in one go

Add all EVM wallets associated with the same address in just one click. Wallets with zero transactions are automatically hidden, significantly de-cluttering the wallets page.

🐞

Latest bug fixes and small improvements

- Re-organized tax related settings to make it tidier and easier to find

- Provide more actionable and clearer errors when importing CSVs

- Added haptics in mobile apps for a better user experience

- Fixed bugs causing some Solana transactions to have incorrect amounts

- Fixed Gemini integration to correctly show instant buys

- Tidied up how things look in dark mode and made it more accessible

- Resolved a bug causing tax professionals to pay more for historical tax years

- Shipped an update fixing several small bugs causing NFTs to have incorrect cost basis

For more, follow us on Twitter. If you are enjoying CoinTracker, please leave us a review on Trustpilot, the App store, or the Play store.

new

improved

fixed

December update: Crypto presents 🎁 coming your way

The season of giving is upon us, and we’re thrilled to share our latest product updates with you.

🧹 Cleaned up spam tokens

Getting rid of unwanted crypto gifts just got easier. CoinTracker now automatically hides spam tokens for you, and you can also review potential spam suggestions on the Tips page.

⭐ Algorand support is here

CoinTracker now supports the Algorand blockchain. Thank you to our ALGO users for their patience and to Kelly, our rockstar intern who made it happen. Add your Algorand wallet today.

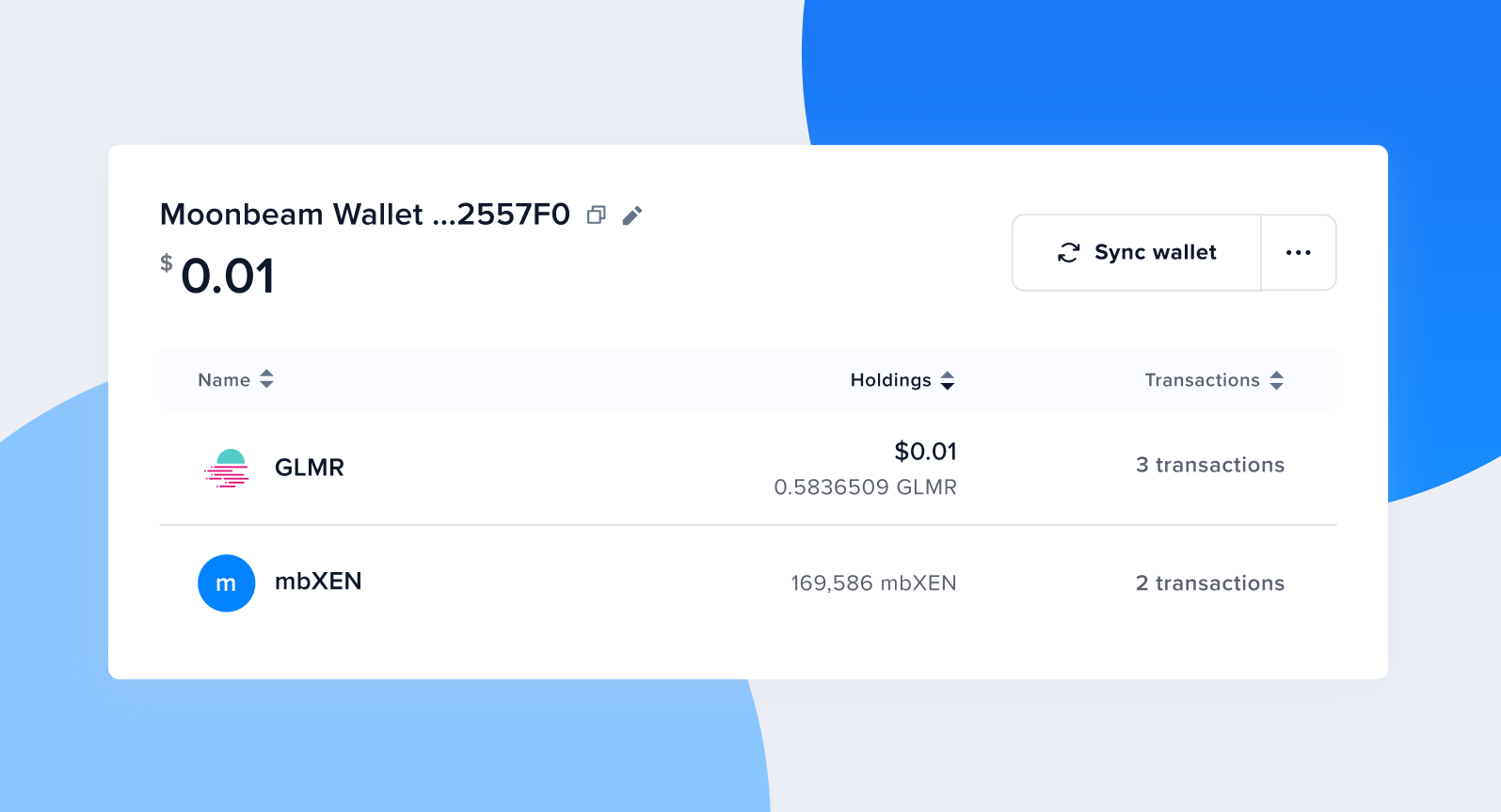

🌝 Add your Moonbeam wallet

CoinTracker now supports Moonbeam wallets. Add your Moonbeam wallet today.

👓 Switch between personal and tax professional views

If you’re a tax professional who uses CoinTracker for personal holdings, you can switch between personal and tax professional views. Things are tidier and better organized, enabling you to make the most out of CoinTracker.

🐞 Latest bug fixes and small improvements

- Shipped clearer and more actionable error messages when importing CSVs

- Resolved transaction errors on Gemini which caused incorrect transactions

- Improved dark mode support for ignored transactions

- Organized tax-related settings together in a new tax setting tab

- Fixed multiple bugs on Solana that improve accuracy of taxes and portfolio tracking

- Resolved cost basis inaccuracies when acquiring multiple NFTs

- Tidied up editing cost basis or proceeds for transactions

- Transactions tagged as lost are now treated as non-taxable for all countries, not just the US

For more, follow us on Twitter. If you are enjoying CoinTracker, please leave us a review on Trustpilot, the App store, or the Play store.

new

improved

fixed

November update: AI 🤝 Crypto

Kick the fright of crypto taxes to the curb this November! With CoinTracker, handling your crypto taxes is all treat, no tricks. Our team is thrilled to share our November updates with you:

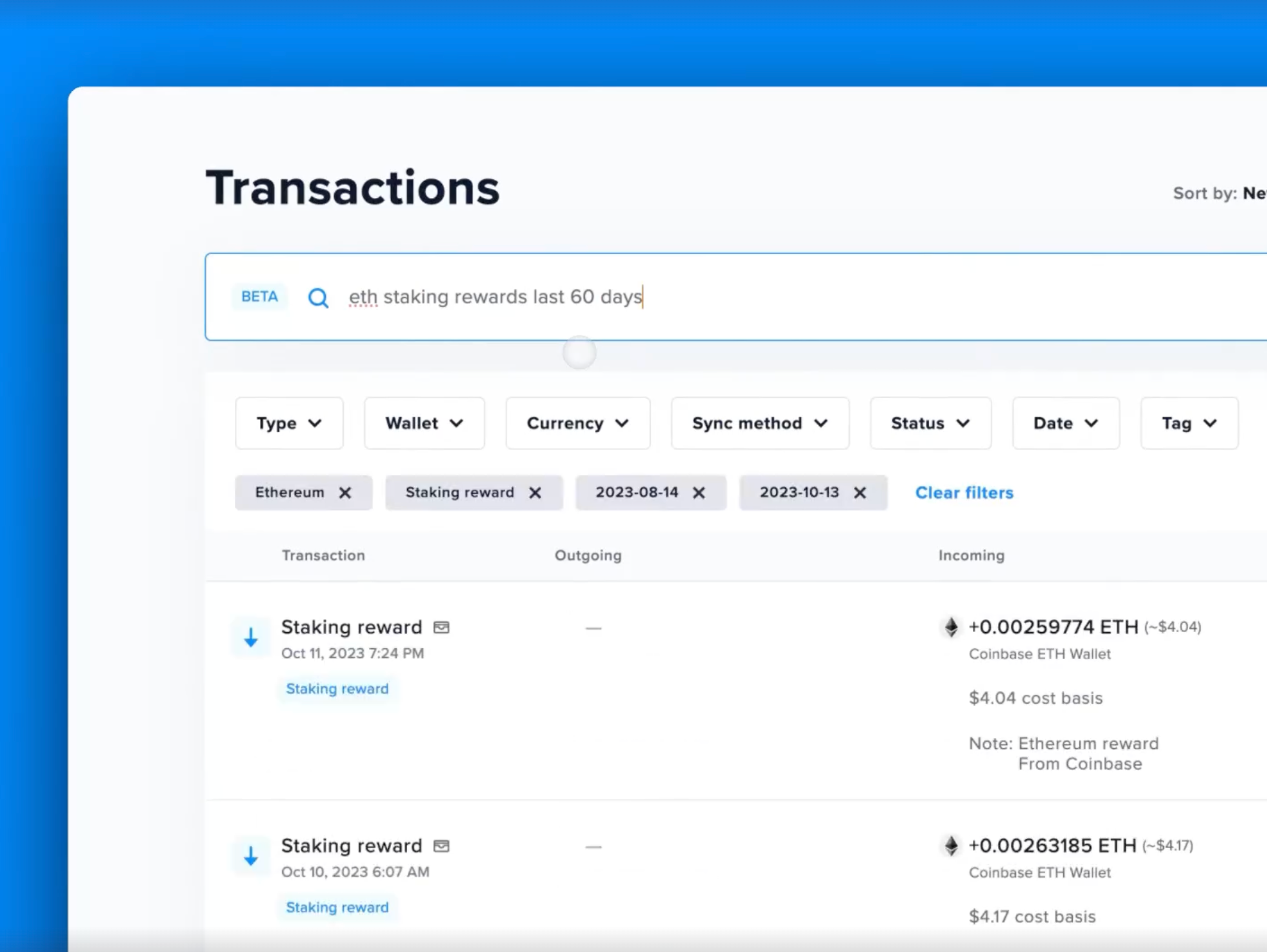

🤖 Transactions search with AI

Wondering about your staking rewards over the past week? Our newly introduced AI-powered search bar swiftly sifts through your transactions, bringing you the answers in seconds. Find exactly what you're looking for faster than ever. Search away!

💸 Ethereum validator staking support

CoinTracker now makes tracking your staking rewards a breeze. Automatically monitor your block rewards and beacon chain withdrawals by simply adding your validator’s withdrawal address. Watch your portfolio grow effortlessly with each new reward.

👀 100 transactions per page

Based on your feedback, CoinTracker now allows you to view 15, 50, or 100 transactions per page. This change makes it easier to bulk tag up to 100 transactions at a time, streamlining your crypto taxes.

🔌 New global sync status

Say hello to our new global sync status feature, conveniently placed in your nav bar. Hover over the icon to stay updated in real-time on your data's freshness and on which calculations are in progress.

🔎 Account sync suggestions

We're creating a new section with tips that’ll help improve your CoinTracker account and expedite your crypto tax journey. To start, we've collected any account sync-related issues in one place for quicker resolution. Check out your account tips today.

🤫 Easily add all EVM wallets

Add all your EVM wallets in one click, syncing wallets across Ethereum, Base, Polygon, and more. Now, with a simple toggle feature, you can also easily hide any wallets with no transactions to minimize clutter. Add your EVM wallets today.

🍂 Tax tips for crypto giving

We're teaming up with Endaoment, an onchain giving platform, to demystify crypto taxability and discuss ways to donate digital assets before the end of the year. Join us via Twitter Spaces on November 8 at 1 PM PT / 4 PM ET — set your reminder here.

🐞 Latest bug fixes and small improvements

- Resolved a bug causing errors on Nexo CSV imports

- Fixed accounting issues with exchange fees and margin

- Tidied transaction tagging on the mobile app

- Ensured wallets start syncing upon login to CoinTracker

- Improved Gemini integration to accurately ingest instant buys

- Address multiple transaction bugs on Solana integration

- Updated transactions page to auto-load new calculations

- Improved password reset experience for social logins

For more, follow us on Twitter. If you are enjoying CoinTracker, please leave us a review on Trustpilot, the App store, or the Play store.

new

improved

fixed

October Update: Dark mode and more!

Happy October! Our team has been hard at work, and we can't wait to share the latest product improvements with you.

Oh, and a little reminder for US taxpayers – the extended tax deadline is on October 16th. Get your crypto tax report today.

Now, let's dive into all the exciting updates 👇

🌚

Dark mode comes to desktop and mobile

You now can choose in settings whether to view CoinTracker in light mode, dark mode, or have it automatically update based on your device’s theme. Just in time for fall’s darker evenings.

🤝

Coinbase staking and earn coverage

Coinbase staking and earn transactions are now auto-tracked on CoinTracker. Coinbase staking balances will be included in your portfolio, and staking rewards will show up as income in the tax center.

🖼️

Expanded NFT coverage

We’ve also added support for ERC-1155 tokens on the following EVM chains: Arbitrum, Avalanche, Base, Moonriver, Optimism, and Polygon. So, more of your NFT trades will now be imported and included in your tax calculations auto-magically.

🧮

Per-wallet tax loss harvesting insights

Portfolio Pro subscribers can now see tax loss harvesting opportunities split out by wallet (using the per-wallet cost basis method). This enables harvesting more losses surgically, by knowing exactly which wallet or exchange to sell assets from.

🇺🇸

US taxpayers: taxes are due October 16

If you filed for an extension or live in a state or county that received an automatic extension, the deadline is approaching. No stress, we’ll help you generate accurate crypto tax reports in a fraction of the time. Get started today.

🤝

Collaborate with your tax pro at no extra charge

We heard your feedback and updated our pricing. Now, you can collaborate with your preferred tax professional on CoinTracker, at no additional charge. Invite your tax pro today.

🐞

Latest bug fixes and small improvements

- NFT sales on Solana now correctly show as Trades, not as Buys

- Assumed proceeds and cost basis can be confirmed directly from missing price warnings

- It is now possible to edit the cost basis and proceeds for all tokens in complex transactions

- We fixed a bug that caused some OKX imports to fail

- We fixed a bug where tax pages wouldn’t load if an account has no transactions

new

improved

fixed

September Update

The IRS just proposed 282-pages of new crypto tax regulations. Our team has sifted through it and summarized it here, outlining how CoinTracker has you covered as the ecosystem evolves. We are also excited to share our latest product updates that make your taxes even easier:

👛

Add wallets seamlessly on mobile

You can now seamlessly add wallets on the CoinTracker mobile apps. We’ve launched a sleeker experience, built specifically for mobile, so you can easily add your wallets on the go. Try adding your exchanges and wallets to CoinTracker today (Android, iOS).

👋

Goodbye spam tokens

No more pesky spam tokens inflating your portfolios. We recently launched an update that fixes spam tokens masquerading as legitimate ones. This fix has automatically been applied to your account, and you’ll see more accurate portfolio balances and transactions. Head over to your dashboard to see it live.

💌

Downloadable tax form links

To protect your privacy, CoinTracker now sends you download links for tax forms rather than email attachments. Pro tip: Save these forms so you can easily refer to them later.

🔢

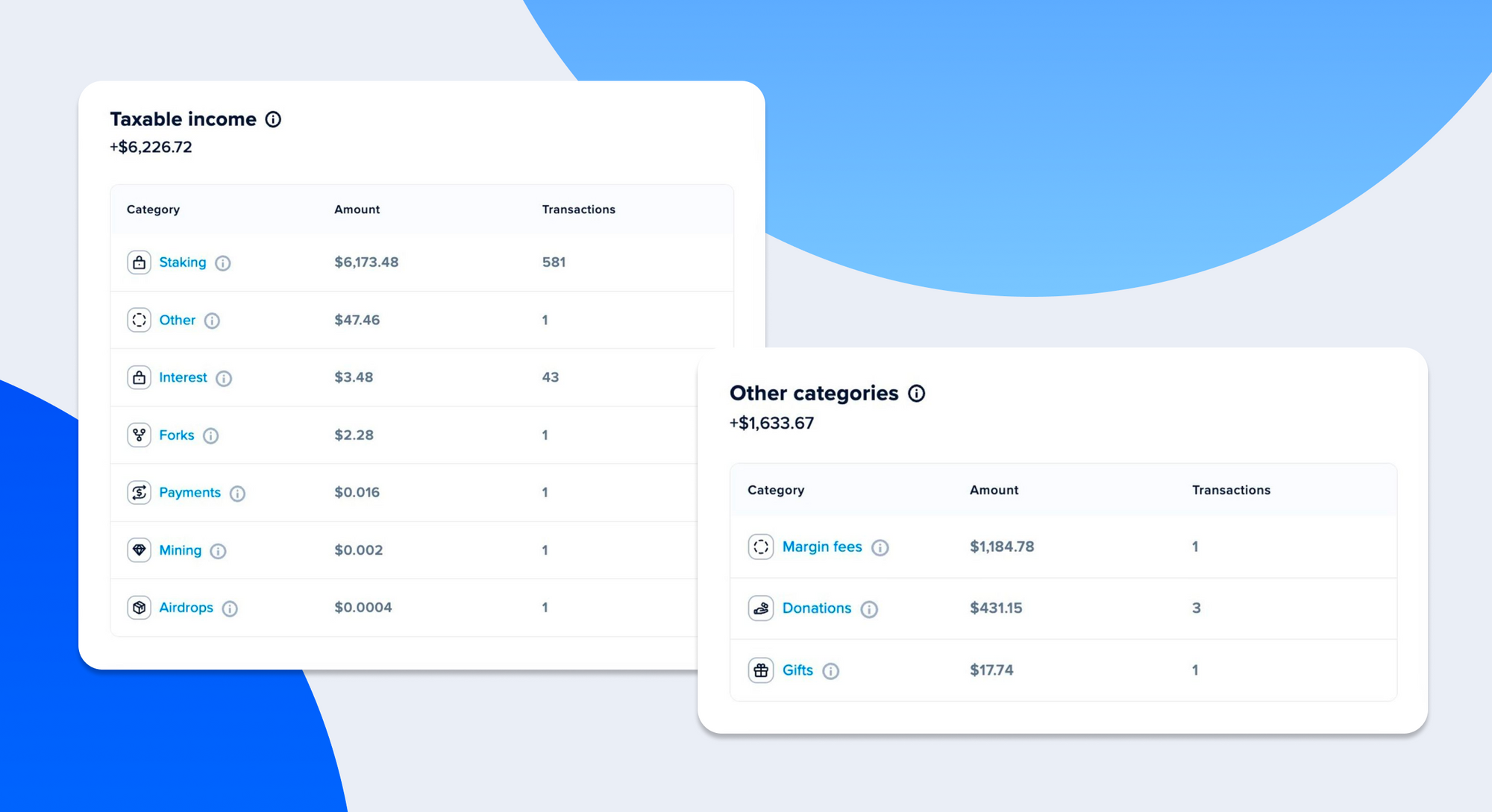

Revamped taxable income section

We have clarified the taxable income section on the tax center. You can now learn more about each category's meaning and how it impacts your taxes. We also added transaction counts so you have additional insight into your income.

🐛

Latest bug fixes

- Coinbase orders with canceled fills are now accurately synced

- Wrapping transactions are now detected across EVM chains

- Fees are correctly handled on the CoinJar Exchange

- Tax summaries always use a country’s tax year rather than the calendar year

- You can now manually edit mint transactions to other types

new

improved

fixed

August Update: Less Taxing, More Relaxing

We hope you’re having a fun summer — we certainly did working on these improvements. Here are some of the updates rolling out to CoinTracker:

🤖 Automatically fetch Lido ETH rewards

If you stake ETH on Lido, we’ll now automatically fetch your staking rewards, including historical rewards, and tag them. We’ve also updated our tax plans to avoid nickel and diming you for many small staking transactions. We hope you feel the warm fuzzies watching the steady accrual of stETH in your wallets.

💸

Coinbase Prime integration is live

You can now add your Coinbase Prime account to CoinTracker to track your portfolio and sync your transactions. Start your taxes early and add your Coinbase Prime account to CoinTracker today.

🏖️ Base mainnet integration is live

If you're ready for Onchain Summer, you can rest easy knowing that CoinTracker has the support you need to prepare for the next tax season. Sync your wallets on Base mainnet to CoinTracker to start tracking your portfolio with ease.

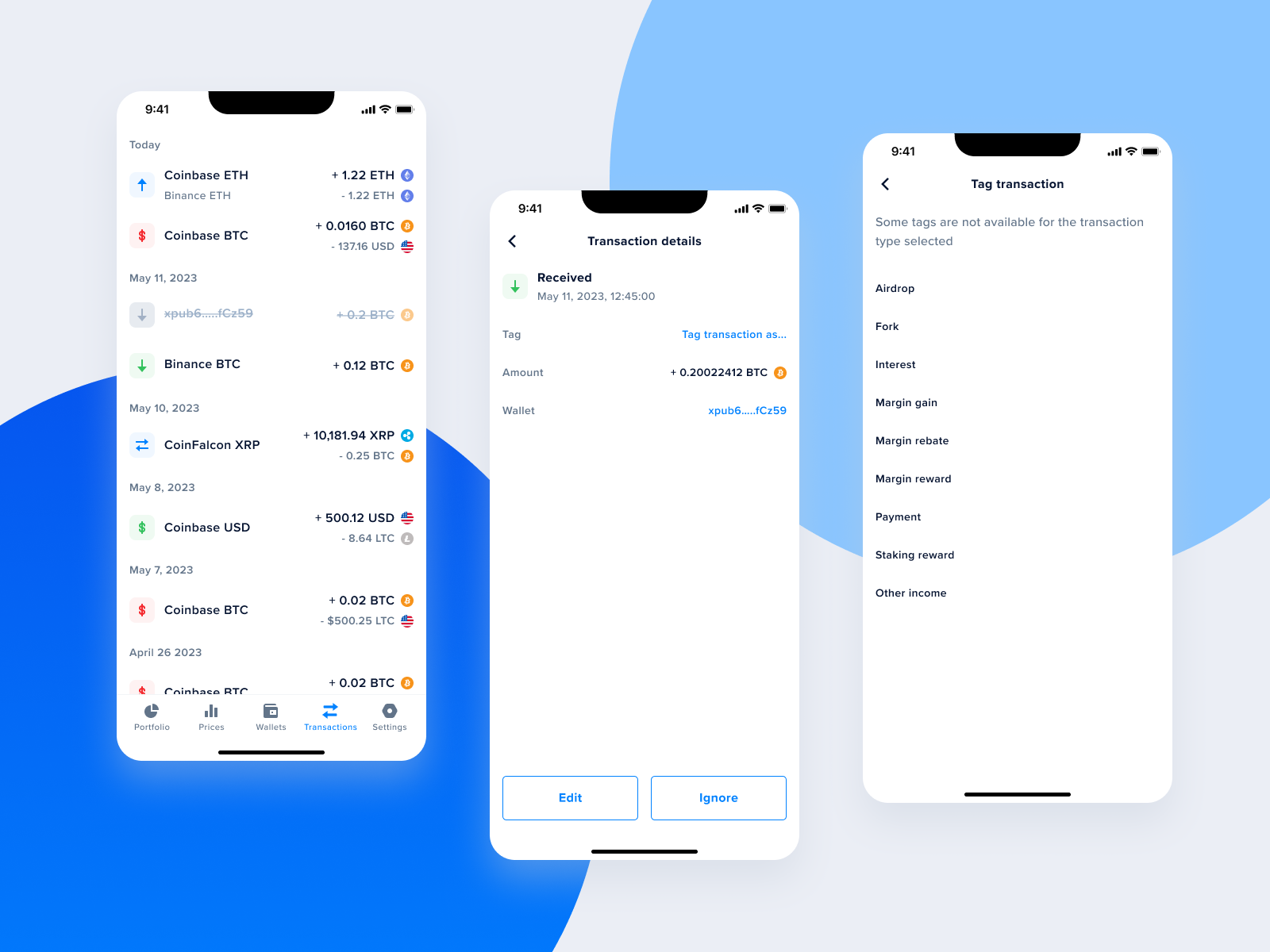

📱 Improved transactions experience in mobile apps

Our mobile apps now show outgoing tokens, incoming tokens, and transaction fees. It's also easier to edit, ignore, and tag transactions. Dive into your transactions on the go:

⚖️ Redesigned portfolio performance

See your portfolio’s value, unrealized return, and total return side by side. Selecting a tab shows how performance has changed over time. And while we were at it, we added an explainer for how performance numbers are calculated.

☁️ Easily import CoinTracker CSVs

Importing spreadsheets to CoinTracker just got a refresh. Our CoinTracker CSV format auto-accepts popular date formats, columns can be in any order, and handles extra-long numbers automatically.

🐛

Bug fixes

- We fixed a bug that caused missing transactions on the mobile app for some users

- We tidied up how CoinTracker looks on iPad

- We stopped the mobile app from crashing when changing country

- We solved an issue preventing Australian users from accessing historical tax reports

- We fixed a bug causing the dashboard to error out for some users

For more, follow us on Twitter.

If you are enjoying CoinTracker, please leave us a review on Trustpilot, the App store, or the Play store.

Load More

→